Even with a significant rebound in Fourth Quarter, stocks and bonds finished 2022 solidly in the red.

Whether the lows reached in October prove to be the turning point in the recent downturn remains to be seen, but it is encouraging to see the inflation rate declining since it reached a 40-year high last June. If that trend continues, it will take some of the pressure off the Federal Reserve to keep hiking interest rates, which will likely boost stocks and will most certainly boost bonds.

2022 was a year where bonds were not immune to volatility–historically bonds are less volatile than stocks. Cash investments are less volatile than bonds. The trade-off for lower volatility is lower expected returns than stocks. Bonds will never eliminate volatility in a portfolio, but historically they’ve proved to be a much better asset class than cash to balance risk and return when seeking to reduce stock volatility.

Whenever stocks and bonds decline together, as they did in 2022, you begin to hear “the 60/40 portfolio is dead.” This is another way of saying that diversifying into fixed income to reduce portfolio volatility doesn’t work anymore, even though it has always worked in the past.

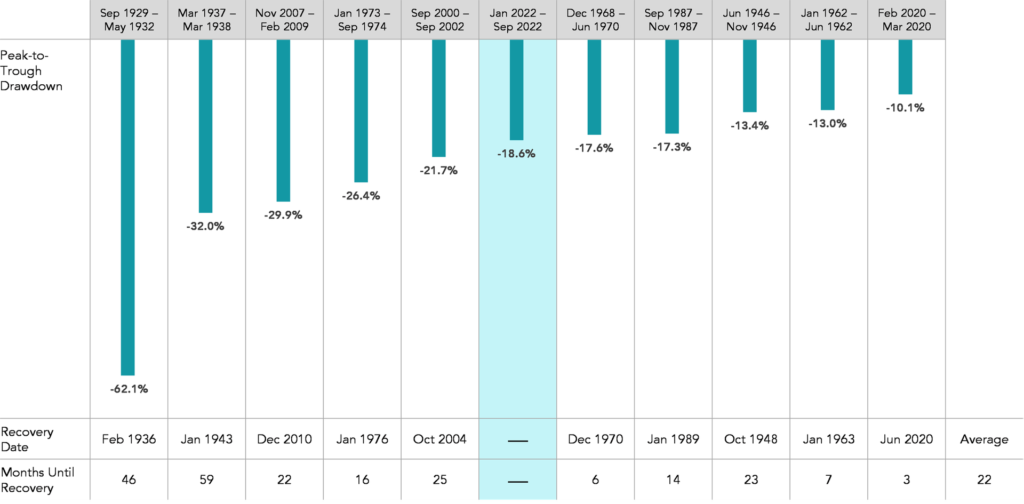

The graph below shows the most significant peak-to-trough declines for a hypothetical portfolio invested 60% in the S&P 500 index and 40% in five-year Treasury notes since 1926. As you can see, the current decline (shaded in blue) is roughly in the middle of the pack and not out-of-the-ordinary when compared to similar bear markets of the past:

Historical 60/40 Returns (January 1926 – September 2022) 1

While the average recovery time for those downturns is 22 months, that average is heavily skewed by the extreme Depression-era bear markets. Most recoveries were significantly shorter than the average.

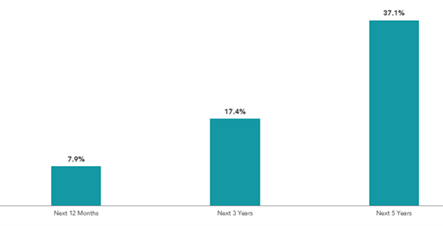

Moreover, once those downturns run their course, they are historically followed by robust recoveries:

Historical Returns for 60/40 portfolio after 10% declines (January 1926 – September 2022) 2

We continue to look at the long-term investment strategy we embraced over 20 years ago, developing a well-diversified, low-cost investment option based on our discussions with you regarding your goals and objectives. That philosophy continues as the foundation of our investment management strategy.